Overview

This certification program is designed to help housing counselors and housing professionals, and/or for HBCU participants competing for jobs in the housing industry, comply with the statutory requirement that housing counseling services must only be provided by HUD Certified Counselors.

Counselors will learn the steps to become HUD certified and will gain the necessary knowledge and skills to meet the certification requirements in order to provide housing counseling services under HUD programs. This comprehensive certification class takes an in-depth look at the six areas of content required to become HUD Certified, including Financial Management, Fair Housing, Homeownership Pre-Purchase, Homeownership Post-Purchase, Avoidance of Foreclosure and Eviction & Tenancy Counseling.

Registration Closes End of Day: Tuesday, September 16, 2024

Learning Objectives

Financial Management

Housing Affordability

Fair Housing

Homeownership

Avoiding Foreclosure

Tenancy/Eviction

Who Should Attend?

This certification program is designed for housing counselors and housing professionals pursuing an emerging level of housing counseling skills for clients. This course equips new housing counselors with basic tools and techniques for housing counseling, adhering to code of conduct and ethics, identifying resources and referral opportunities, case management plans for credit financial management, and comprehending fair housing laws.

Scholarship Eligibility

To be eligible for the full tuition and or material scholarship applicants must meet one the following criteria:

- A Housing Counselors and or housing professional employed by a HUD approved Housing Counseling Agency for which a HUD approved or HCA or HCS with an HUD agency ID.

- A student body, alumni, faculty, and staff for one of the Historically Black Colleges and Universities, (HBCUs), with whom the Neighborhood Stabilization Corporation, its subsidiaries and affiliates has an established partnership to train.

For more information on how to apply click here Scholarship Program

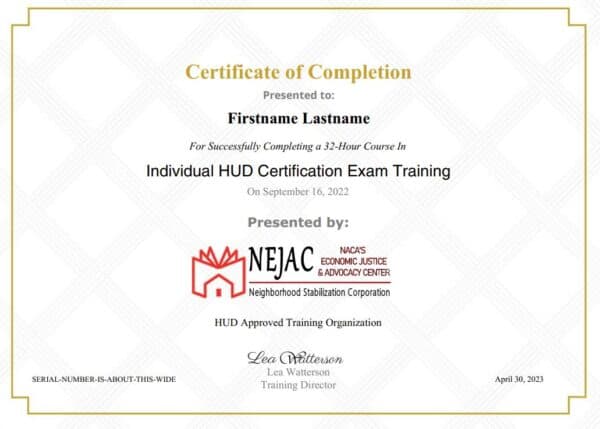

Certificate

Participants will receive a certificate of completion upon completing the training curriculum and final exam.

Curriculum

Day 1 Course

Financial Management: Participants will understand the importance of properly implementing a budget and action plan; the role of credit, fair credit regulations and using credit wisely; managing and protecting assets.

Day 2 Course

Housing Affordability: Participants will learn and demonstrate the ability to outweigh housing options, assess affordability, explain mortgage types, insurance, and products; down payment assistance and other housing affordable options.

Day 3 Course

Fair Housing: Participants will learn by evaluating case studies of violations and complaints; identify local fair housing resources; applying working knowledge of filing complaints; understanding how to affirmatively further fair housing.

Day 4 Course

Homeownership: Participants will be able to evaluate client’s purchase readiness; roles of the professionals involved in the homebuying process; understand standard mortgage practices and documentation; be equipped to explain post purchase responsibilities including maintenance, safety, energy efficiency, and selling a home.

Day 5 Course

Avoiding Foreclosure: Participants will be able to explain the foreclosure avoidance strategies, retentions options; disposition options and identifying resources to assist clients retain their home or transition out of their home.

Tenancy/Eviction: Participants will be able to explain the responsibilities of tenancy, avoidance of eviction, transitional and emergency shelters, and the importance of understanding ad abiding by the lease agreement and conflict resolution with a landlord.